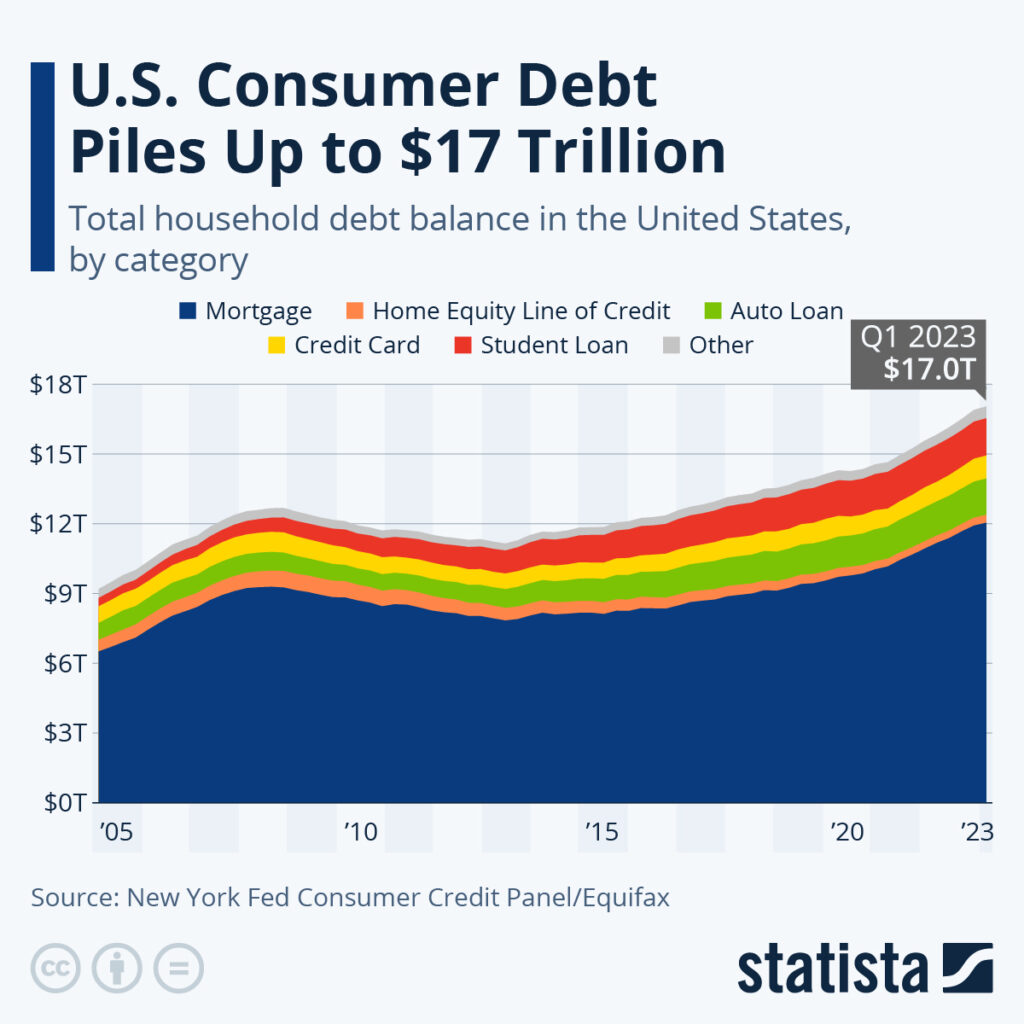

U.S. household debt reached a record high of $16.90 trillion in the final quarter of last year, marking the largest quarterly increase in two decades, according to a report from the Federal Reserve. The rise in mortgage and credit card balances was fueled by high inflation and rising interest rates. The surge in overall debt can be attributed to the Federal Reserve’s efforts to address an imbalanced economy and combat soaring inflation rates. However, the report also raises concerns about delinquency rates and the ability of borrowers, particularly younger individuals, to repay their debts.

Record-High Debt and Imbalances:

The New York Fed’s quarterly household debt report revealed that household debt increased by $394 billion in the last quarter, with total debt now standing $2.75 trillion higher than before the onset of the COVID-19 pandemic. Of particular concern was the substantial increase in credit card balances in December, which marked the largest year-over-year increase since records began in 1999. Mortgage debt also experienced significant growth, rising by $254 billion to reach $11.92 trillion by the end of December. However, despite the rise in debt, mortgage originations fell to levels last seen in 2019.

Monetary Tightening and Economic Challenges:

The surge in overall debt can largely be attributed to the Federal Reserve’s efforts to counterbalance an imbalanced economy and combat high inflation rates. In 2022, the central bank increased its benchmark interest rate from near zero in March to over 4% by the end of December, representing the fastest pace of monetary tightening since the early 1980s. These measures aimed to temper demand and address the excess money supply, which was contributing to inflation and labor shortages in various sectors. Additionally, the global rise in food and energy costs due to Russia’s invasion of Ukraine further compounded the economic challenges faced by the U.S.

Implications for Various Debt Types:

The report highlights notable increases in credit card balances and auto loan balances. Credit card balances rose by $61 billion in the fourth quarter, while auto loan balances increased by $28 billion. The rise in interest rates impacted the housing market, resulting in a cooling effect as the cost of mortgages surged. Despite improvements in supply chains and increased availability of goods, the labor market remains tight, with the unemployment rate reaching its lowest level since 1969 in January. Delinquency rates also rose for credit cards, auto loans, and mortgages, particularly among younger borrowers struggling to make repayments.

Challenges and Borrower Ability:

While historically low unemployment rates have generally supported consumers’ financial stability, the persistently high prices and climbing interest rates are now testing borrowers’ ability to repay their debts. Wilbert van der Klaauw, an economic research advisor at the New York Fed, noted that the combination of elevated prices and rising interest rates poses challenges for borrowers. These challenges are particularly evident among younger borrowers, who are facing difficulties in meeting their credit card and auto loan repayment obligations.

Future Outlook and Monetary Policy:

The Federal Reserve has already raised its policy rate and currently maintains a target range between 4.50% and 4.75%. Market expectations indicate the likelihood of at least two more 25 basis point rate hikes before the Fed pauses to allow its actions to permeate through the economy. The aim is to mitigate the risk of a potential recession and provide time for the impacts of rate hikes to take effect.

Conclusion:

The significant increase in U.S. household debt to a record high highlights the challenges faced by borrowers amidst an evolving economic landscape. Rising interest rates, high inflation, and imbalances in the economy have contributed to the surge in debt, particularly in mortgage and credit card balances. Delinquency rates have also shown an upward trend, with concerns arising regarding borrowers’ ability to repay their debts, especially among younger individuals. The Federal Reserve’s monetary tightening aims to address these economic challenges, but its effects are still unfolding. As the economy adapts to evolving conditions, it remains important to closely monitor debt levels and ensure sustainable financial practices to safeguard households and the overall economy.